Blogpost

2.4 minute read

November 03, 2020

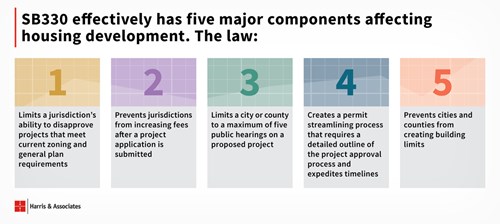

On October 9, 2019, Governor Newsom signed into law Senate Bill 330 (SB 330), The Housing Crisis Act of 2019. In effect until at least January 2025, SB 330 addresses California’s statewide housing shortage by limiting a jurisdiction’s ability to change standards, requirements, or fees after a housing project has a completed application.

The bill changes certain aspects of the Permit Streamlining Act and Housing Accountability Act. While the bill modifies regulations regarding project approval, timelines, procedures, and penalties, this post will focus on the changes to a jurisdiction’s ability to increase development impact fees.

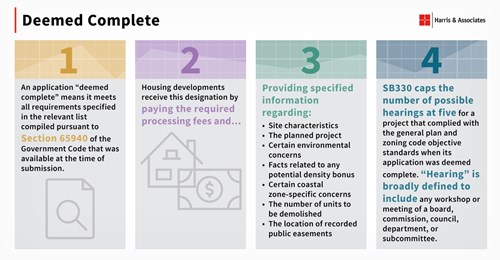

Understanding “Deemed Complete”

SB330 prevents jurisdictions from changing development fees, policies, standards, and zoning ordinances after they receive a development application that is “deemed complete.” Development fees can only increase by an automatic escalation and only if the resolution or ordinance establishing the fees calls for such.

For an application to be “deemed complete,” it must meet all requirements specified in the agency’s checklist at the time of the submission and is considered complete regardless of recognition or approval by the governing body. Applicants must pay all required processing fees and provide specific information regarding:

- Site characteristics

- Project plans

- Specific environmental concerns

- Facts related to any potential density bonus

- Specified coastal zone-specific concerns

- The number of units to be demolished

- Location of recorded public easements

A housing project that changes the number of residential units or square footage by 20% or more would no longer be “deemed complete” until the developer resubmits the required information again. The housing project must commence construction within 2 ½ years of approval to be eligible for these protections.

Assessing Fees Now Pays Off Later

With agency budgets already maxed out, maximizing impact fee collection to fund critical infrastructure becomes increasingly important. To protect these revenues, leaders should assess and potentially modify their current fees and should ensure an automatic inflation factor is included. If an agency doesn’t take these steps, they risk losing the ability to collect adequate fees to fund critical infrastructure. In addition, agencies must properly track the fees that are applicable based on the date of the completed application to ensure proper impact fee collection.

The experts at Harris & Associates are available to help with this fee analysis, advise on application protocols, and help meet SB330 compliance. For a detailed write-up on SB 330, download our SB 330 white paper.

We are not a law firm and our employees are not acting as attorneys. The information contained should not be construed as legal advice. Please consult an attorney before making any decisions regarding the information contained in this post.

Authors

Source

Harris & Associates

Markets

Services

Municipal Finance

Special District Services

Categories

SB 330